The zoom stock has really been true to its name, zooming ahead, racking up returns like nothing else. Not only was it not affected by covid-19, in fact, it turned out to be a baller stock. The stock, which had IPOed at about 40$ a share was already up to 100$ when the pandemic struck. Post that it went up about 2.4 times to 240$ per share.

I understand the euphoria behind the stock. But I also think that a lot of zoom's future is grossly overestimated. A few points made regularly in support of the stock's future are:

- Remote work is the future bro!

- Zoom is such an awesome product bro!

- Did you look at their earnings growth bro?!...

These are all very valid points. But they're true only in the current situation. If we want to justify the current market price of the stock, we need to look at the future. The stock is priced to perfection. Based on an analysis by Tanay, the company needs to grow at a crazy pace (~77% every year for 5 years) AND maintain its attractive margins till 2025 to justify the price right now. I'll try to dig deeper into reasons why it possibly wouldn't. At the end of the piece, if you think the fears are overstated, you can atleast agree that the risk here is definitely more than what's being perceived right now.

How do B2B sales work?

B2B sales are very different from B2C sales. For a B2C sale, things like branding, loyalty, perception matter as much as the actual product. That explains why Apple was able to sell so many phones back in late 2000s even though Android had some compelling devices in the lineup.

For a B2B sale, the equations are simple - Companies want the best product at the cheapest prices. The process of purchase is not based on 'feels'. The product specs are compared, products tested out, and based on the price difference the final product is selected. So we can boil down B2B sales to 3 key factors - feature set/performance, distribution, and prices.

Attracting the sharks - how long before the features don't matter?

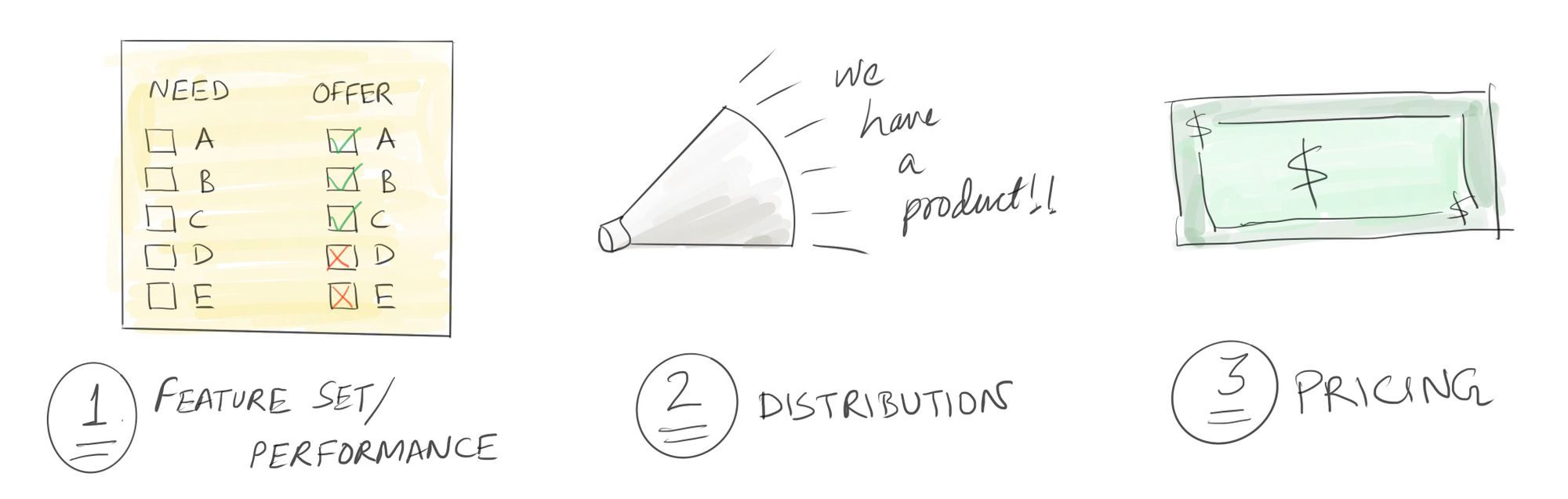

Video conferencing isn't really a new beast. It has been there for long but none of the bigger competitors had really solved for it well. As a result, legacy players like Cisco Webex were doing great work, based on their core competency of networking. However, remote meetings and online interactions had not been mainstream for a long time and people preferred face to face meetings. But with the increasing bandwidth all across the world and more cultural acceptance of remote meetings compared to in-person meetings, the market has been growing tremendously. Covid has helped push this change in social psychology which bodes well for the business and not so much for the smaller players.

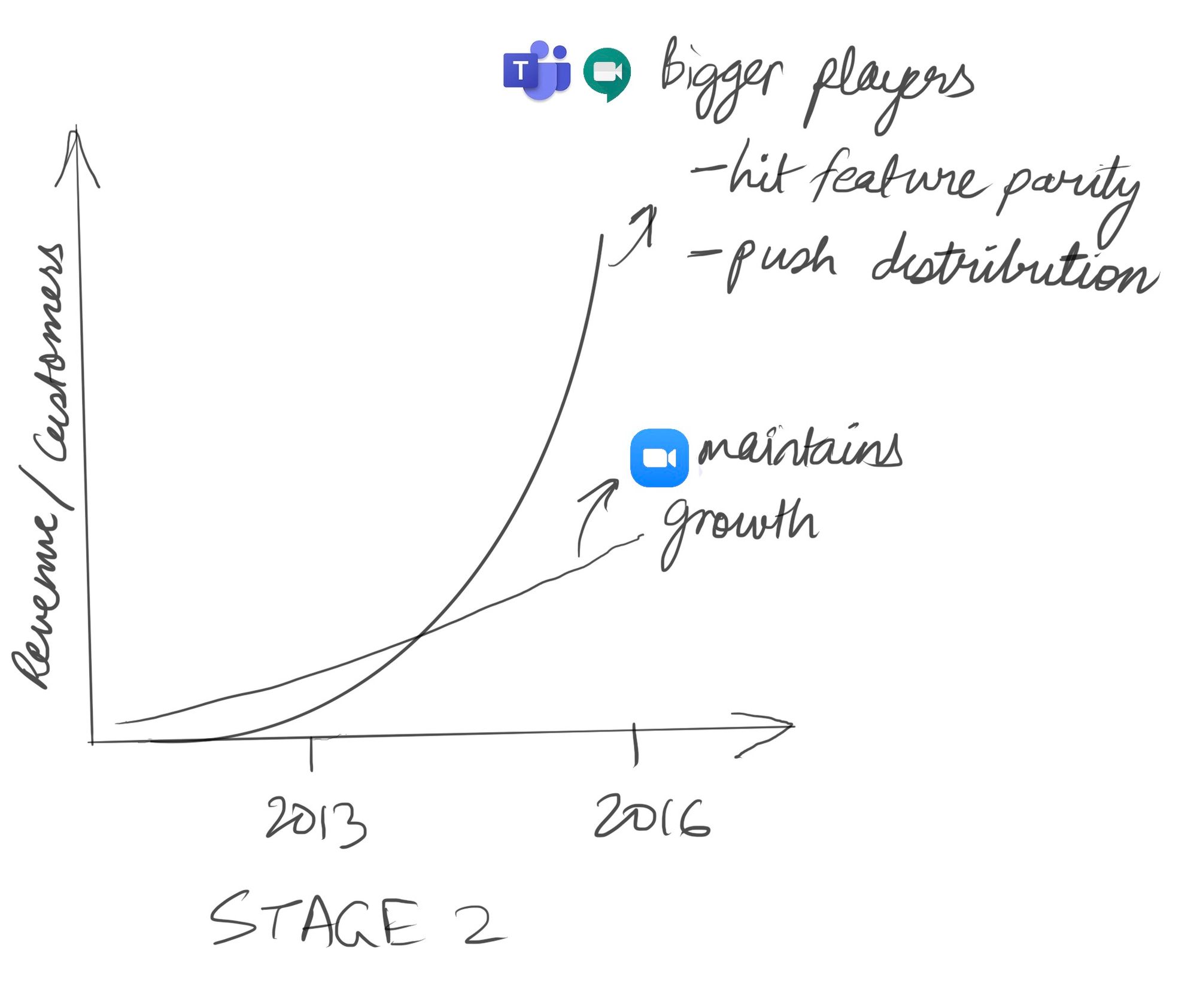

A lot of noise about this opportunity has meant a lot more focus on it by other larger players. Bigger firms like Microsoft and Google HAVE to look at new growth opportunities to meet the expectations set by wall street. So, if a big enough opportunity shows up, they are not shy of capitalizing on it and adding to their existing topline and bottomline. MS and Google have been doing exactly that. Google has focussed on a 'meeting' product and MS has worked hard on strengthening their video conferencing product that's bundled with MS Teams.

Compared to Zoom, these organizations have a lot more resources. With focus, they can meet and exceed the feature-set provided by Zoom no matter what they might be - weak-internet performance, drop rates, video quality, concurrent connections, latency etc. It's a matter of time when that tip happens and from the looks of it, it's going to happen sooner rather than later.

Distribution - the key to this business!

Once the feature set discussion is done, it becomes a game of who can reach how many businesses. Zoom's bad luck is that the people that it sells to are the same people who buy from Google and Microsoft.

What's worse, EACH organization has to reach out to Google or MS to setup its business basics like Gmail/Google suite or Outlook/MS Office.

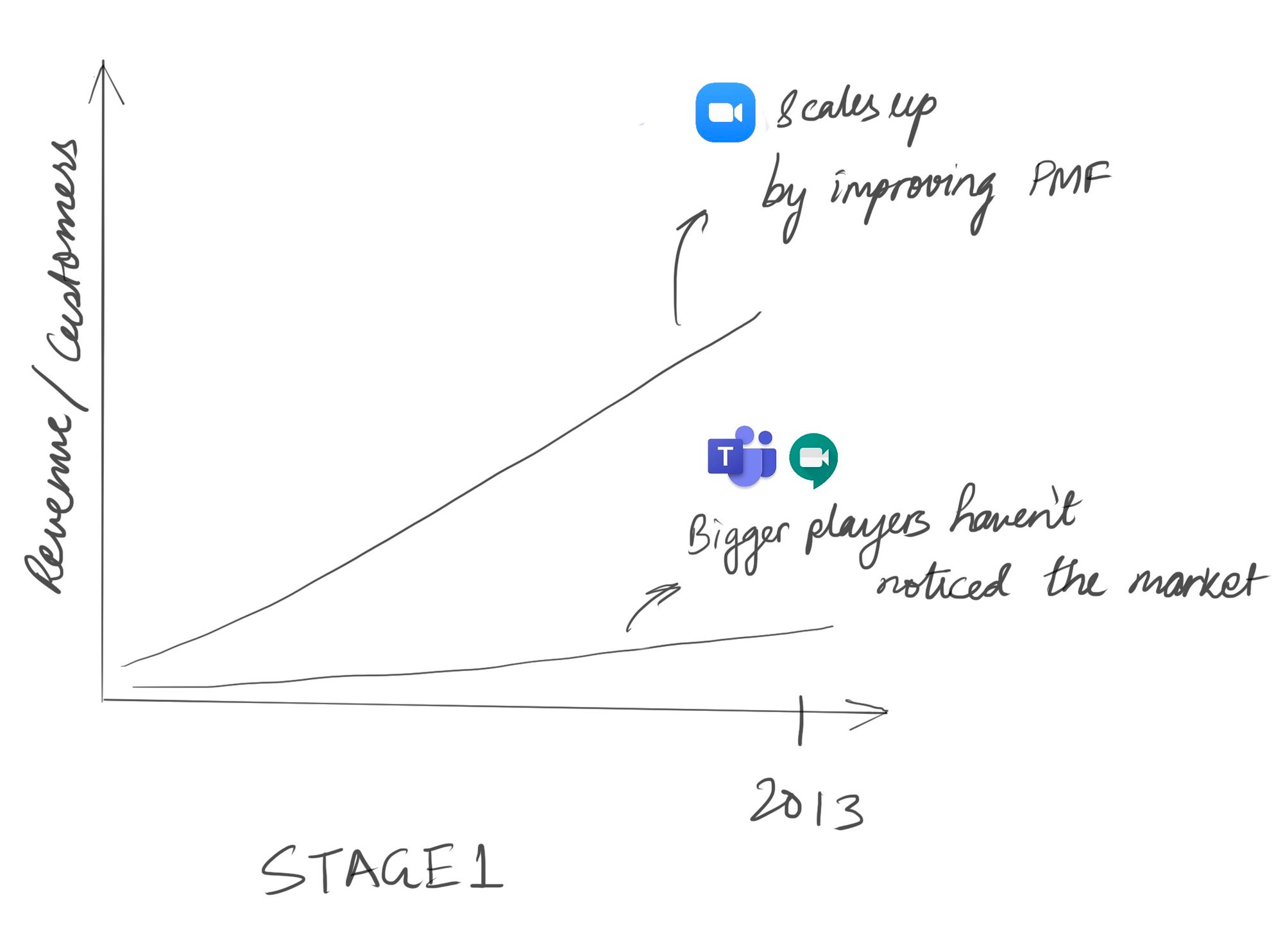

Let's see how much Zoom spends on sales and marketing.

We can see that it spends about 70% in Sales and general expenses. That figure is huge! But let's say with a larger user base, the figure comes down to about 30%. How does that compare with Microsoft and Google? If you think about it, the big dogs wouldn't spend anywhere close to 30% on selling their new video conferencing product. The selling cost would be marginal for them considering they already have a large sales force which is selling similar products to the same businesses.

It's a huge advantage for the big players that they would not think twice before milking. What's going to happen once the big dogs match-up with Zoom on features and understand they don't have to spend a lot of additional money on sales?

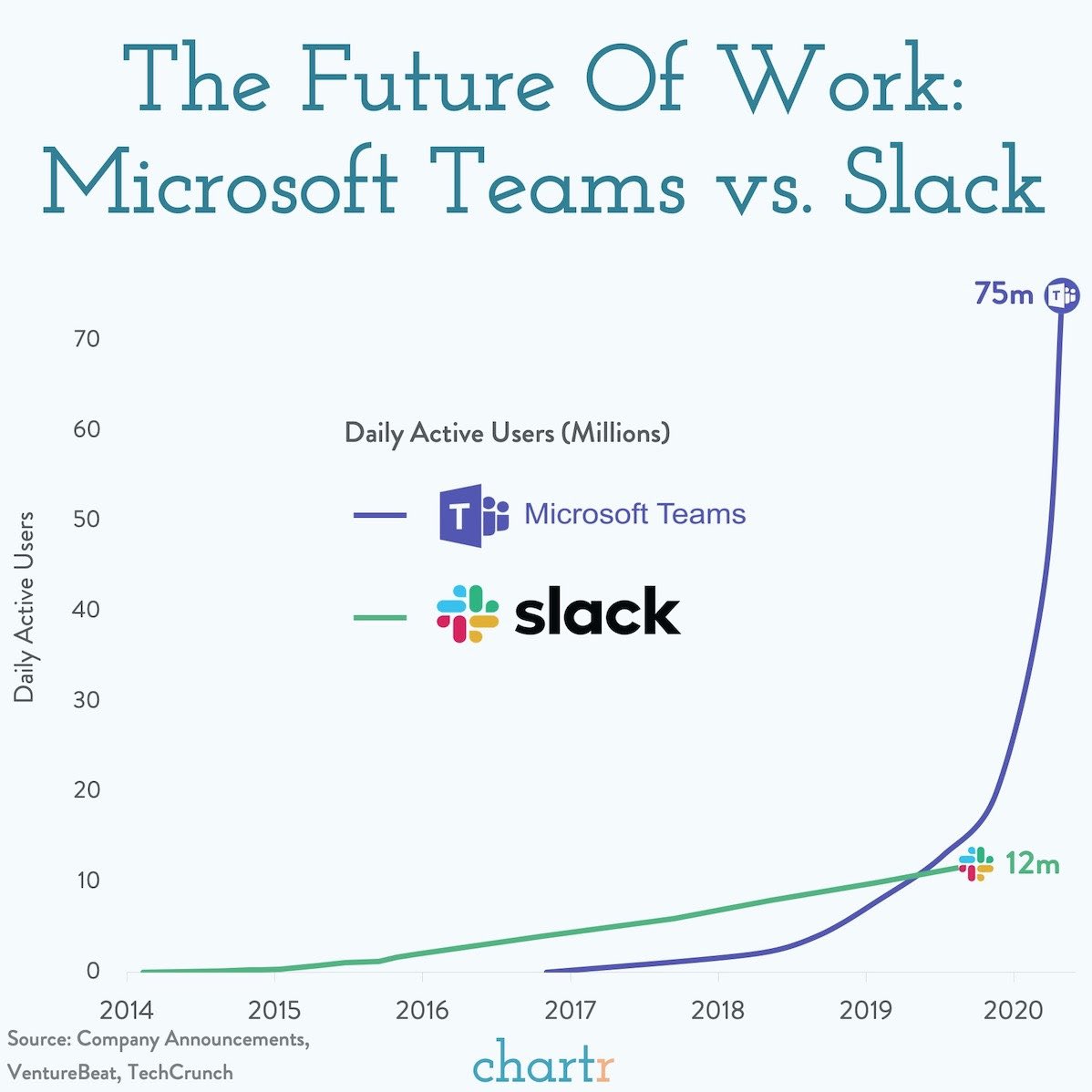

We should look at how MS teams scaled up compared to Slack when they hit feature parity. It left Slack CEO cribbing about how MS 'copied' features. Sadly, they could do no more. Check out this graph below on the number of active users for Teams vs Slack. I'm sure MS Teams padded the data here so it might not be super accurate. But this gives a fair enough warning.

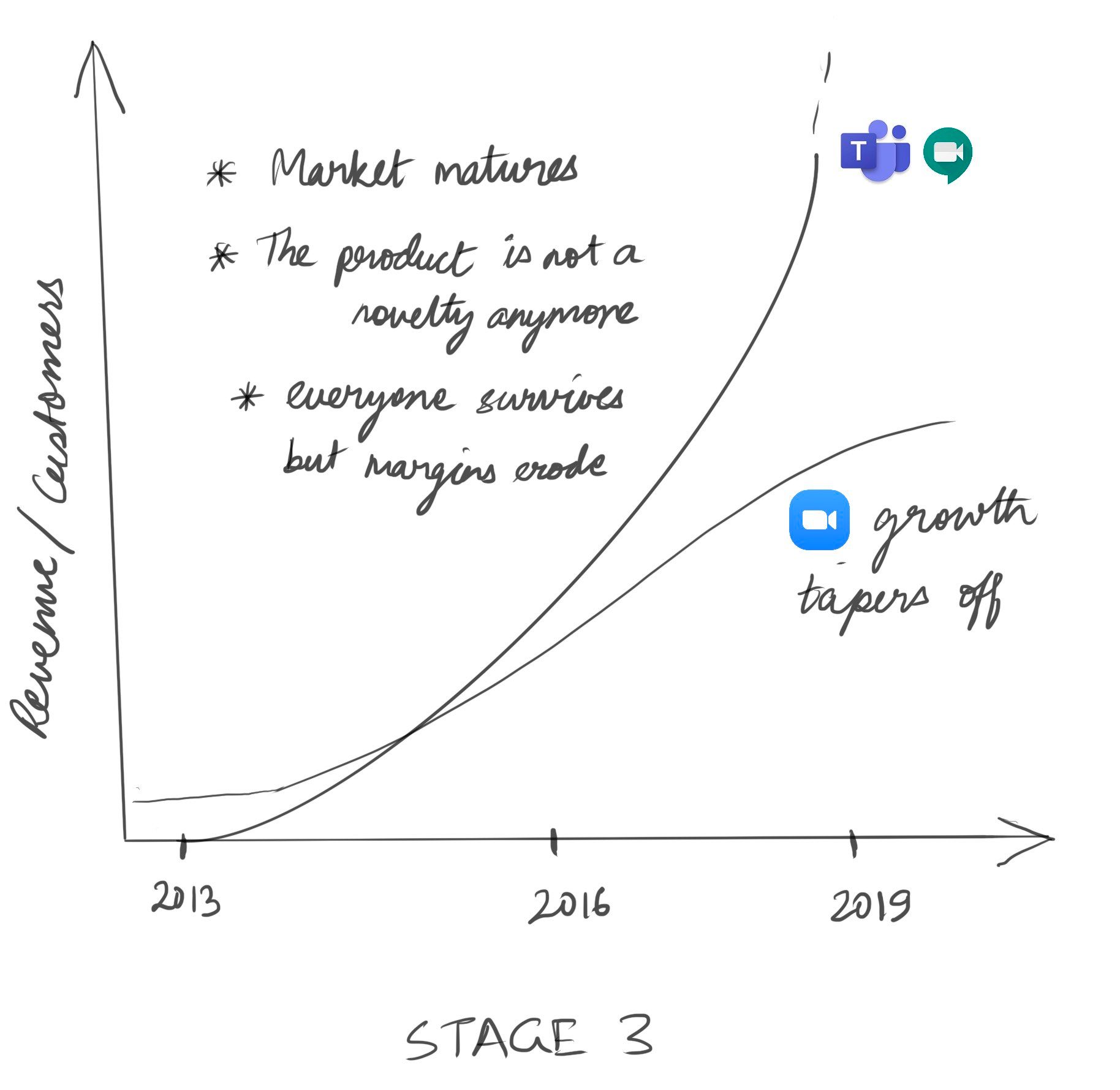

Eroding margins - competing on prices

The only logical step would be to undercut zoom on prices. Now, this need not be a straight 20% discount because that would attract lawsuits. It can be done much more subtly.

Imagine you're a startup or a small enterprise with about 100 employees. You need to provide a useful communication tool to your employees so that they're more productive. You reach out to zoom and slack and you see it's going to cost you about 100,000$. On the other hands, MS Teams offers you the same setup at 30,000$ additional expense on top of your existing MS Office subscription. Considering you're tight on budget (as always) and the 2 products have similar features and performance, what would you do??

Of course, you would rather extend your MS Office or Google license and purchase this service as an add-on.

At this stage, the products would be almost similar and the price for the big dogs would be significantly lower, and we would see the growth for zoom and slack tapering off. Over a longer period of time, we would see customers migrating away towards MS or Google considering setting up a new VC system for your organization isn't that much of a hassle. Especially since you'll be saving money. The market would have matured and all the euphoria around zoom would die out and its market cap would get added to MS/Google's.

So how can I make money off this?

What's an insight where you don't have a skin in the game. In the current crazy markets, it's really tough to take a call (or a put :p).

Markets can remain crazier than you can stay solvent. It's a risk especially when you're shorting stocks with margin.

In this case, the best thing to do would be to track earnings posted by zoom. And short it when we see weakness in the growth story. The euphoria around a stock typically wears off when the market sees less than expected growth in revenue/earnings. That's why a lot of executives are driven to do everything just to meet the quarterly numbers set by the wall street folks. So whenever the earnings wiggle and we see volatality in the prices, go short!